The journey of caregiving is often a complex, emotional, and deeply rewarding experience. As we reach a certain stage in life, the roles begin to shift, and we find ourselves faced with the responsibilities of caring for our aging loved ones. This transitional phase, though born out of love and concern, can also lead to tensions and challenges, especially when navigating the intricate web of family dynamics. For those in the caregiving age demographic, finding ways to work together harmoniously as a family becomes paramount in ensuring that our caregiving efforts are rooted in respect, empathy, and collaboration.

Tip 1: Foster Open Communication

Communication is the cornerstone of any successful endeavor, and caregiving is no exception. Initiate open dialogues where family members can express their thoughts, concerns, and wishes. Encourage active listening, allowing each voice to be heard, and validate emotions. As Dr. Maya Angelou once wisely said, “I’ve learned that people will forget what you said, people will forget what you did, but people will never forget how you made them feel.”

Tip 2: Embrace Each Other's Strengths

Every family member brings unique strengths and abilities to the caregiving journey. Embrace these strengths and divide tasks accordingly. By recognizing and valuing each person’s contribution, you create an atmosphere of shared purpose and cooperation.

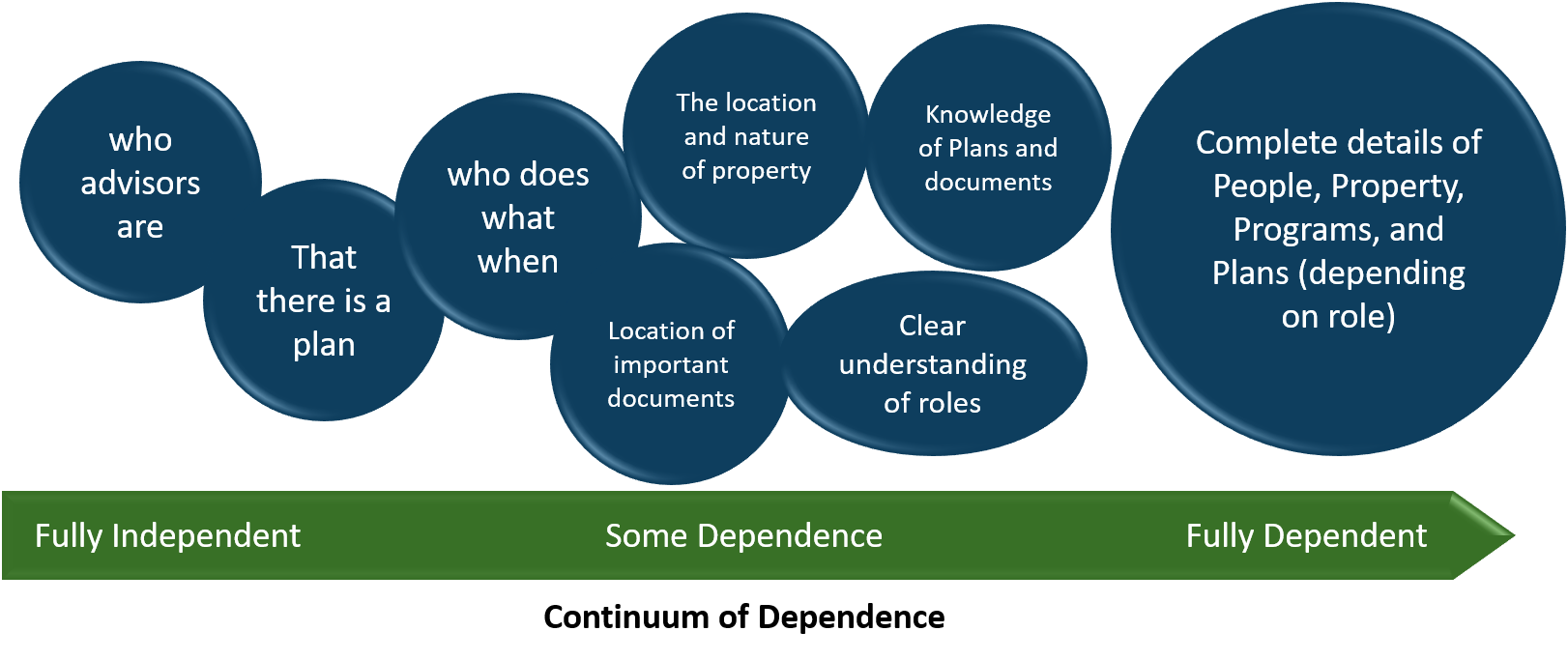

Tip 3: Seek Professional Guidance

Sometimes, external advice can ease the strain of family dynamics. Engage a professional mediator, counselor, or geriatric care manager to provide a neutral perspective and guide your discussions. Their expertise can offer insights that help in making difficult decisions while preserving family bonds.

Tip 4: Establish Boundaries with Respect

Caregiving often involves intimate aspects of an individual’s life. Set clear boundaries and respect each other’s personal space and autonomy. Dr. Jane Nelsen reminds us, “Respect is a two-way street; if you want to get it, you’ve got to give it.”

Tip 5: Maintain Flexibility

The caregiving journey is filled with unexpected twists and turns. Flexibility is key in adapting to changing circumstances. Remember that everyone is doing their best, and sometimes, the ability to adapt gracefully is the most valuable skill of all.

Tip 6: Celebrate Small Victories

Amid the challenges, don’t forget to celebrate the small victories. Whether it’s a successful medical appointment or a cherished moment shared, acknowledging these moments can uplift spirits and foster a positive atmosphere.

Tip 7: Preserve Family Traditions

As caregiving becomes a central focus, it’s essential to preserve and cherish family traditions. Engaging in shared activities and celebrating milestones can help maintain a sense of continuity and connection.

Research conducted by the National Institute on Aging underscores the importance of a united family front in caregiving, noting that strong family support positively impacts both the caregiver’s well-being and the care recipient’s overall quality of life. Dr. John Gottman, renowned for his work on relationships, emphasizes the significance of emotional bids and responding positively to them. This principle can be applied to caregiving, where acknowledging and reciprocating efforts can strengthen familial bonds.

In the realm of caregiving, family dynamics are an integral part of the equation. By fostering open communication, embracing each other’s strengths, seeking professional guidance, establishing respectful boundaries, maintaining flexibility, celebrating small victories, and preserving family traditions, families can navigate this challenging yet meaningful path with grace, compassion, and togetherness. As we embark on this journey, let us remember that by supporting one another, we create a legacy of care, respect, and love that will continue to resonate through generations.